Will the U.S. Use a Crypto Gambit to Default on Its Debt?

Au-RRange Ventures Bridge to Righteous Outcomes Passion Driven. Experience Led. Will the U.S. Use a Crypto Gambit to Default on Its Debt? Context In September

Commodities have long been the bedrock of economies, from energy and metals to agriculture and rare earths. They are not only raw materials but also strategic assets that reflect geopolitical tensions, inflationary pressures, and sustainability challenges.

In the coming decade, commodities will play an important role in shaping geopolitics, economics and potentially new monetary systems.

Our research, not only track developments in precious metals but also key industrial metals like copper, aluminium and steel. We examine supply-demand imbalances, price volatility, and the impact of global events such as trade restrictions, conflicts, and climate change.

For investors, commodities present both risk and diversification opportunities. Our insights help in understanding how commodity super-cycles evolve, how inflation and monetary policy influence pricing, and where alternative investments (such as carbon credits) are reshaping the landscape.

By combining macroeconomic perspectives with sectoral deep dives, we provide a comprehensive view of how commodities influence capital flows, investment strategies, and corporate resilience.

In 1924, John Maynard Keynes, a famous British economist wrote in his book “A Tract on Monetary Reform” that gold is a barbarous relic and argued that the gold standard was an outdated and impractical system that hindered economic stability and flexibility, especially for 20th-century democracies. Warren Buffet, considered a global high priest of fundamental or value investing, once said that gold is an unproductive asset as it doesn’t pay any dividends or interest.

#Gold #Commodities #CentralBanks #InflationHedge #MonetaryAsset #ReserveManagement #USD #Dedollarisation

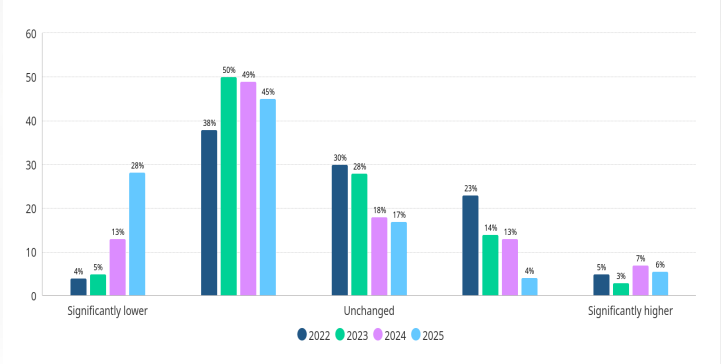

Each year World Gold Council conducts an anonymous and a short survey of major central banks. This year survey saw highest participation with 73 respondents from 58 central banks. The findings are very instructive as the survey is future focused and peels into what’s behind central bank reserve management policy.

#Gold #CentralBanks #Reserves #US$ #De-dollarisation

Silver, the metal with a split personality, is firing on all cylinders. Its industrial side faces a severe, structural supply shortage, while its monetary side awakens to follow gold as a premier safe-haven asset. When these two powerful forces collide, history shows the price moves can be legendary. Is this the beginning of another historic super-spike? Uncover the full story behind this explosive rally and its future…

#Silver #PreciousMetals #Commodities #Bullion

Beneath the hum of every data center and the whir of every electric motor lies a thread of copper, carrying the current of a new world. It powers our cities, our cars, and our ambitions and yet, its story is far from simple. Dr. Copper: The Industrial Currency takes a deep dive inside the metal that built our past and now defines our future, revealing a brewing tug-of-war between innovation and scarcity. The question isn’t whether copper can keep up, rather, it’s what happens if it can’t…

#Copper #AIrevolution #Cleanenergy #MetalsandMining #Commodities

Au-RRange Ventures Bridge to Righteous Outcomes Passion Driven. Experience Led. Will the U.S. Use a Crypto Gambit to Default on Its Debt? Context In September

For companies facing distress, whether due to wrong capital structure, operational challenges,regulatory shocks or market disruptions, the ability to act quickly and decisively can make

Credit is the lifeline of modern economies, enabling businesses to expand, innovate, and withstand cycles of uncertainty. Yet, credit markets are inherently cyclical, influenced by