About

about

Au-RRange Ventures is all about Gold Standard pursuit of passions of its founder and managing partner, Bharat Gupta. For clients and subscribers, Au-RRange acts as a Bridge to Righteous Outcomes.

Learn more about our Values that define who we are.

Founder & Managing Partner

Bharat is a free spirit, with an Indian heart and a global mind. An adventurous soul, who has always chosen a challenge over settling for comfort and certainty. Bharat’s life is full of examples, where he has pursued his passion over the conventional and mostly excelled at his choices:

1991

Deciding to pursue CA over medicine or engineering at young age of 15.

2000

Leaving job with A F Ferguson management consulting to join a “start-up” in “risky” beer business with a South African company.

2003

Stepping out of finance role to lead a very successful post merger integration.

2004

Becoming youngest expat in Johannesburg, South Africa at the age of 28 and first one to be picked from Indian operations of SABMiller.

2006

Leaving the expat role in South Africa to pursue a self-funded full time MBA from London Business School, UK.

2007

Choosing Corporate Turnarounds as a career, a niche field over Strategy consulting and having the courage to drop out of strategy consulting interview process.

2007

Co-founding a student club on Corporate Turnarounds at London Business School, organising events, including a landmark conference and finding a dream job.

2016

Leaving lucrative role and comfortable life in Dubai, to a more chaotic but deeper market in India, just when Bankruptcy code came into effect.

2016 – 2024

Acting in senior interim roles (CRO, CFO, COO), through his post MBA career to lead from the front, drive change and putting his own reputation on line.

2021- 2025

Author of half yearly EY Private Credit reports and playing an important role in bringing media attention to private credit in India.

2025

Leaving a prestigious partnership at EY, to pursue his passion projects through Au-RRange Ventures LLP.

Bharat brings close to 30 years of diverse work experience in India, Southern Africa, UK and Middle East. During this period, he has worked for A. F. Ferguson & Co. (number 1 professional services firm in India, until 2000), SABMiller India (global beer major), worlds top turnaround & restructuring firms Alvarez & Marsal (India & Middle East) and AlixPartners (Middle East) and EY (India’s leading professional services firm and a leader in Restructuring & Turnarounds).

By education, Bharat is a Chartered Accountant and MBA (London Business School). He has also completed several AI & Digital Transformation courses.

Timeline of Bharat’s career, experience overview, education and professional testimonials can be accessed here:

https://www.linkedin.com/in/guptabharat/

Over the years, Bharat has also developed deep interest in geopolitics, transformative potential of artificial intelligence, equity investing, commodities and precious metals.

Outside of work, Bharat enjoys running (several half marathons in India and UAE), mountain climbing (several high passes and peaks of over 6000 mtrs in India, Nepal, Tibet, France & Tanzania), reading (non-fiction) and listening to music (mostly lounge music).

Au-RRange Ventures is an expression of who Bharat is, his impact on the world and his Experience in Action

Our Values. Our Anchor.

Our Values define who we are, what drives us and how we work. It is our anchor in crisis, turbulence and uncertainty.

We pursue challenging and difficult assignments. It is the FIRE of our values that keeps us warm during difficult times and helps us sleep well at night.

Freedom

Freedom of thought and action. Learn from everyone but decision is ours.

Integrity

Integrity above everything else. It is our currency.

Respect

Mutual respect in all our interactions. Self-respect is equally important in today’s short term, profit driven capitalist society.

Empathy

Empathy in all its forms – Cognitive. Emotional. Compassionate.

Media Coverage

India’s Own Private Credit Firms Drive First $10 Billion Yearr

“If the RBI allows state-run banks to fund high rated M&A deals, then public sector banks will take share away from foreign banks who've been benefitting more from the regulatory arbitrage.” Said Bharat Gupta, Managing Partner at Au-RRange Ventures, a research services firm

#PrivateCredit #Credit #SpecialSituations #CapitalRaise #Turnaround #Restructuring #IndiaDistressMarket #GrowthCapital #M&A #CRO

Private credit deals rise 47% to $7.8 billion in 2023

Bharat Gupta, debt and special situations partner, EY India, said, “A growing economy, a cautious banking sector and a deliberate reduction in the wholesale books of NBFCs continue to provide a fertile ground for funds to grow and deploy capital.”

#PrivateCredit #Credit #SpecialSituations #CapitalRaise #Turnaround #Restructuring #IndiaDistressMarket

#PrivateCredit #Credit #SpecialSituations #CapitalRaise #Turnaround #Restructuring #IndiaDistressMarket

India private credit: Local managers enjoy fundraising spree

The rise of onshore private credit funds is driven by the confluence of several events. Growing interest from family offices and HNWIs tracks a period of aggressive wealth creation via the public markets post-COVID-19 and a subsequent desire for asset diversification. Private credit is a popular choice within alternatives, according to Bharat Gupta, a debt and special situations partner at EY India.

#PrivateCredit #Credit #SpecialSituations #CapitalRaise #Turnaround #Restructuring #IndiaDistressMarket #GrowthCapital #M&A #CRO

Private credit deals hit record high at $7.8 billion in 2023: Report

According to Bharat Gupta, debt and special situations partner at EY, a growing economy, a cautious banking sector and a deliberate reduction in the wholesale books of NBFCs continue to provide a fertile ground for private credit funds to grow and deploy capital.

#PrivateCredit #Credit #SpecialSituations #CapitalRaise #Turnaround #Restructuring #IndiaDistressMarket #GrowthCapital #M&A #CRO

Global funds eye entry into Indian private credit space

“India’s economic performance vis-à-vis rest of world, more conviction about sustained economic growth, foreign policy successes, a more stable currency versus others have made them take interest in Indian private credit,” said Bharat Gupta, EY India strategy and transactions partner.

#PrivateCredit #Credit #SpecialSituations #CapitalRaise #Turnaround #Restructuring #IndiaDistressMarket #GrowthCapital #M&A #CRO

Private credit funds to invest $5 billion to $10 billion in 2024, says EY report

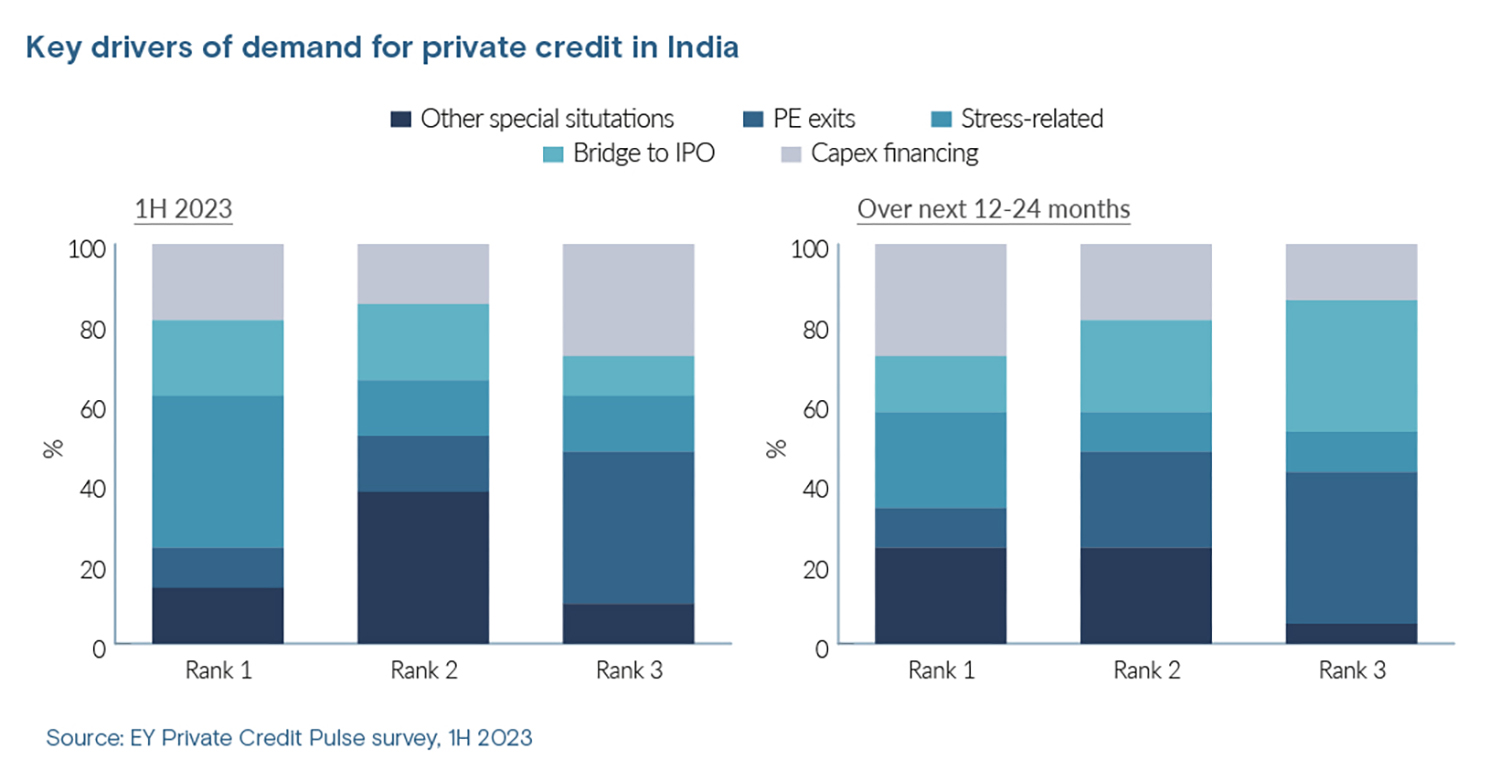

The report surveyed leaders from top credit funds where half of them think spending on projects will drive private credit deals in the next 12 to 24 months, followed by stress-related financing. Real estate is expected to have the most deals, followed by manufacturing, but it's seen as the riskiest sector. Despite enough funds, competition is rising.

#PrivateCredit #Credit #SpecialSituations #CapitalRaise #Turnaround #Restructuring #IndiaDistressMarket #GrowthCapital #M&A #CRO

From Manipal to Shapoorji, private credit has tasted blood in India. What comes next?

“Large fundraises, falling interest rates, and higher competition are all leading to pressure on private-credit yields,” said Bharat Gupta, partner at EY, an accounting-and-consulting firm. “Mistakes are bound to happen.”

#PrivateCredit #Credit #SpecialSituations #CapitalRaise #Turnaround #Restructuring #IndiaDistressMarket #GrowthCapital #M&A #CRO

Many global investors go slow on India private credit

Private credit may be the buzzword in the investing world, but many bulge bracket investors have remained tight-fisted as far as the Indian markets are concerned. While those like Carlyle, SoftBank and CDPQ, who were exploring an entry into the Indian private credit market, have kept away so far, existing ones such as KKR and Goldman Sachs are going slow on it.

PharmEasy finds high-yield cure

"For several quarters now, private credit fundraising activity is much higher than the number and value of deals in India," said Bharat Gupta, founder of research firm Au-RRange Ventures and former strategy and transactions partner at EY India. "When more money is chasing fewer deals, mistakes are bound to happen and risk can get mispriced, especially for cashflow-based lending secured by equity."

#PrivateCredit #Credit #SpecialSituations #CapitalRaise #Turnaround #Restructuring #IndiaDistressMarket #GrowthCapital #M&A #CRO

India Set to Open $40 Billion M&A Market to Local Bank Funding

“If the RBI allows state-run banks to fund high rated M&A deals, then public sector banks will take share away from foreign banks who've been benefitting more from the regulatory arbitrage.” Said Bharat Gupta, Managing Partner at Au-RRange Ventures, a research services firm

#PrivateCredit #Credit #SpecialSituations #CapitalRaise #Turnaround #Restructuring #IndiaDistressMarket #GrowthCapital #M&A #CRO

Bharat summarises key findings of the EY half yearly Private Credit report issued in August 2024

Hear Bharat Gupta, founder and Managing Partner at Au-RRange Ventures and former Partner at EY India, speak about Private Credit in India. Bharat summarises key findings of the EY half yearly Private Credit report issued in August 2024. Bharat pioneered reporting on Private Credit in India and developed a comprehensive report format that has become a benchmark in India.

#PrivateCredit #Credit #SpecialSituations #CapitalRaise #Turnaround #Restructuring #IndiaDistressMarket #GrowthCapital #M&A #CRO

Get in touch with Bharat

Media Coverage

Domestic firms are gaining market share thanks to India’s push for infrastructure spending, which has sprouted a crop of smaller, greener borrowers needing smaller loans. Local players, such as Neo Asset Management and Edelweiss.

Domestic players are gaining market share as deal size shrinks

India’s heavy infrastructure spending is boosting deal volume<

Domestic players are gaining market share as deal size shrinks

India’s heavy infrastructure spending is boosting deal volume

Private credit deals have seen a jump of 47% in CY2023 to $7.8 billion in value terms compared to $5.3 billion in CY 2022, said auditing and consultancy firm EY in a report. The number of deals went up to 108 in 2023 from 77 in 2022, the report said.The increase in both deal count and value was fuelled by several factors, including the stabilisation of interest rates in CY 2023e

Global investor Fortress Investment Group, US-based HPS Partners, Qatar-based Power International Holding (PIH) and others are evaluating deals in the Indian private credit space. All of them are in touch with investment bankers in India for deals in private credit, said sources aware of the developments.